Usually, bank accounts are created for saving money and making other transactions smoothly. It is one of the safest, most secure, and most transparent ways for all financial activities. Despite this, some individuals find this way prolonged. There is an alternative way of sending and receiving money instead of making transactions from a bank account. if you do not want to use a bank account for your transactions then you can move with MoneyGram. but, if you are not aware of how to fill out MoneyGram, then this article will assist you in each step.

What is MoneyGram?

A MoneyGram is an American-based service portal that is created to make financial transactions in a simplified way rather than proceeding with a traditional bank account. It is an easy, safe, and secure way for transactions. If you want to access it, you should move on to how to fill out a moneygram transaction form.

If your top priority is a safe and secure method, then Moneygram is above all payment methods. You just have to fill out moneygram money order form, which requires some basic details of the sender and receiver.

Required Documents

- full name and address of the recipient

- sender’s contact details and address

- your signature

- reason for money order

- a valid ID proof

- city name where you are sending a money order

- purchase date

- description of the amount ( you are sending in dollars)

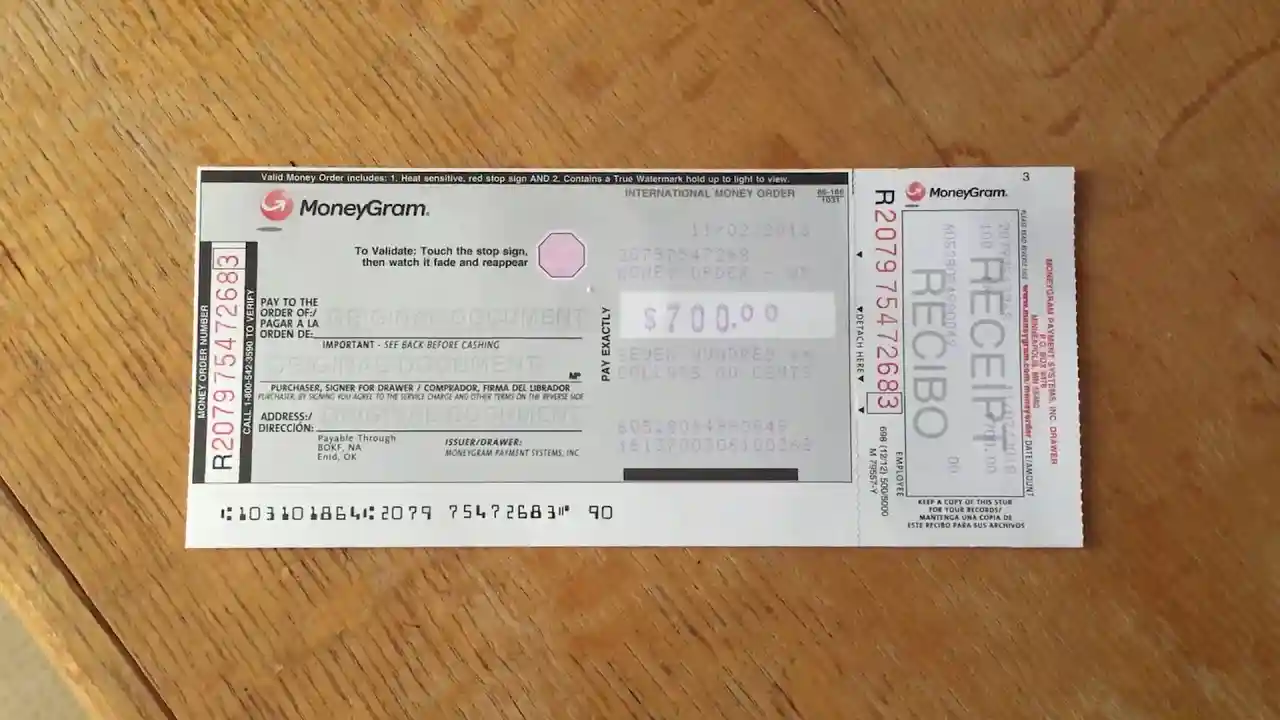

How to fill out a money order MoneyGram?

If you are anxious about how to fill out a money order MoneyGram, then be relaxed. Filling out money order MoneyGram or filling out a money order on MoneyGram is not a complex process. If you are a new user, still, you can complete the process without any difficulty. Here, you will find an explanation of its filling process and other essentials. Read out carefully.

- Download and install the MoneyGram app on your mobile or laptop.

- Create an account on the app.

- For filling out MoneyGram money order, log into your account.

- On the homepage, you will find the “Find the Location” option. click on it and search for the nearest MoneyGram location center.

- Visit the nearest MoneyGram center and purchase a money order that is free of cost.

- On the fill out MoneyGram money order form, fill in the recipient’s full name carefully at the top of the form. Remember, all information should be filled in the capital letters only.

- Now, enter the sender’s address and your name in the purchaser section at the bottom of the form.

- Enter your account number in the “Payment No/ Account Number” column. If you did not find this, then write at the top of the form.

- Write the reason for the money order in the ‘Memo ‘section.

- Now, deposit the processing fee and keep the receipt of the money order.

now, you are aware of filling out a money order on MoneyGram. just, avail of the services without any difficulties.

Read more : How to Manage Working Capital For know more in detail visit The lick simply.