Key Takeaways

- Automation significantly reduces manual data entry, enabling faster, more accurate expense processing.

- AI-powered tools enhance compliance by automatically enforcing company policies and detecting anomalies.

- Mobile-first solutions provide employees with convenient, on-the-go expense reporting capabilities.

- Integration with existing financial systems ensures seamless data flow and real-time financial insights.

- Automated expense management improves employee satisfaction by simplifying the reimbursement process.

Table of Contents

- Automation Reduces Manual Data Entry

- Enhancing Compliance with AI

- Mobile-First Solutions for Modern Workforces

- Seamless Integration with Financial Systems

- Improving Employee Satisfaction

- Conclusion

In today’s competitive business environment, the efficiency of operational processes can determine a company’s agility and long-term sustainability. Expense management, traditionally a tedious task mired in paper receipts and manual spreadsheets, is evolving thanks to automated solutions that change the way organizations handle spending. As companies strive for greater scalability and data-driven decision-making, expense control has become a cornerstone for maintaining financial stability and improving workflow efficiency.

Automated platforms offer much more than just speed; they provide a foundation for improving accuracy, ensuring regulatory compliance, and making it easier for employees to report spending. These systems are not only replacing manual entry methods but also transforming the entire approach to expense oversight, enabling businesses to manage resources more effectively. The result is a workplace where financial transparency increases, errors are reduced, and staff time is allocated to higher-value activities.

Digital transformation in finance is not just about convenience; it is about creating value at every stage of the expense lifecycle. According to Rho’s blog, organizations that leverage technology for expense management experience a significant reduction in processing time and fraud risk. Automation equips managers with real-time data and systematic controls, creating a more transparent and responsive financial structure.

As organizations embrace these changes, the focus shifts from reactive expense processing to proactive cost control and optimization. The visibility and insights provided by automated systems enable finance leaders to forecast and allocate budgets with greater precision, supporting long-term business strategies.

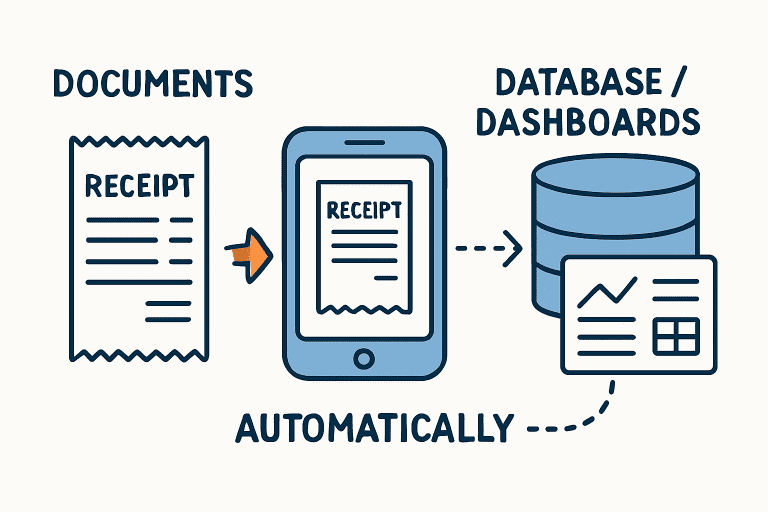

Automation Reduces Manual Data Entry

The burden of manual data entry has long been a source of frustration for finance teams. Optical Character Recognition (OCR) technology allows employees to submit receipts by snapping photos, with the platform automatically extracting key details such as date, amount, and vendor. The automation of tedious data entry tasks eliminates not only human error but also the delays caused by backlogged approvals and manual reconciliation efforts.

By reducing the time spent on administrative work, teams can redirect their focus to higher-impact activities such as strategic planning, analysis, and supplier negotiations. Industry research from Rho’s blog shows that finance teams using automation handle 4 times as many transactions without increasing headcount, highlighting the scalability automation delivers.

Enhancing Compliance with AI

Compliance in expense management is critical to avoid costly violations and ensure adherence to both internal and external policies. Artificial Intelligence has emerged as a powerful tool for enhancing compliance. AI-powered platforms can flag out-of-policy transactions, duplicate submissions, or huge expenses. These intelligent systems are programmed to follow company rules and regulatory mandates, ensuring compliance and reducing the risk of fraud or errors.

The use of AI not only mitigates financial risk but also simplifies audits. Since data is consistently categorized and anomalies are highlighted as they occur, finance teams can respond to issues immediately rather than waiting for quarterly or year-end reviews. This continuous monitoring reduces the likelihood that compliance issues will escalate unnoticed.

Mobile-First Solutions for Modern Workforces

As today’s workforce becomes increasingly mobile, expense management must adapt to employees working remotely, traveling, or collaborating across multiple locations. Mobile-first platforms empower employees to submit expenses in real-time directly from their devices. Features like snap-and-upload receipts, voice-to-text entry, and instant notifications speed up the reporting process and encourage participation.

Improved accessibility leads to higher compliance rates, as employees are more likely to submit documentation promptly. Moreover, timely reporting shortens reimbursement cycles, alleviating cash flow concerns for staff and boosting overall satisfaction.

Seamless Integration with Financial Systems

Integration is essential for expense management solutions to deliver maximum value. By connecting with core financial systems such as Enterprise Resource Planning (ERP) and accounting platforms, automated expense tools offer seamless data transfer. This integration reduces the risk of errors in manual exports and imports and ensures that expense data supports real-time financial reporting.

Finance teams gain immediate access to company-wide spending analysis, improving budget accuracy and supporting better cash flow management. Decision-makers can spot emerging trends and adjust spending policies proactively rather than react after the fact, thereby strengthening financial control across the organization.

Improving Employee Satisfaction

Streamlined expense processes offer direct benefits to employee experience. When reimbursements are processed quickly and transparently, employees feel valued and are less likely to express frustration with back-office inefficiencies. Automation removes much of the administrative burden, empowering staff to dedicate more time to value-added activities and less to paperwork.

Companies that prioritize user-friendly expense management solutions reinforce a culture of trust and support, while also improving productivity and morale across departments.

Conclusion

The shift toward automated expense management is more than a technological upgrade; it is a strategic move that empowers organizations with the tools and insights required to compete in a rapidly changing business landscape. By embracing OCR, AI-driven compliance, mobile reporting, and seamless integration, companies position themselves for greater financial control, improved accuracy, and a more satisfied workforce. As these technologies continue to evolve, forward-thinking businesses that invest in automation will solidify their place as industry leaders.