Managing household budgets can always be a bit of a challenge, but with the right strategies, it becomes much easier to keep on top of your finances. By implementing small changes, you can surprisingly make a big difference to your financial health. These ten practical tips are simple, effective, and great to help Australian families with budgeting.

- Set Clear Goals

Start by defining your financial goals. Whether it’s saving for a home deposit, paying off debt, or taking a well-earned holiday, having a clear goal keeps you motivated. Write down both short-term and long-term goals and break them into achievable targets. Being clear about what you’re working towards will give your budget purpose.

- Track Your Spending

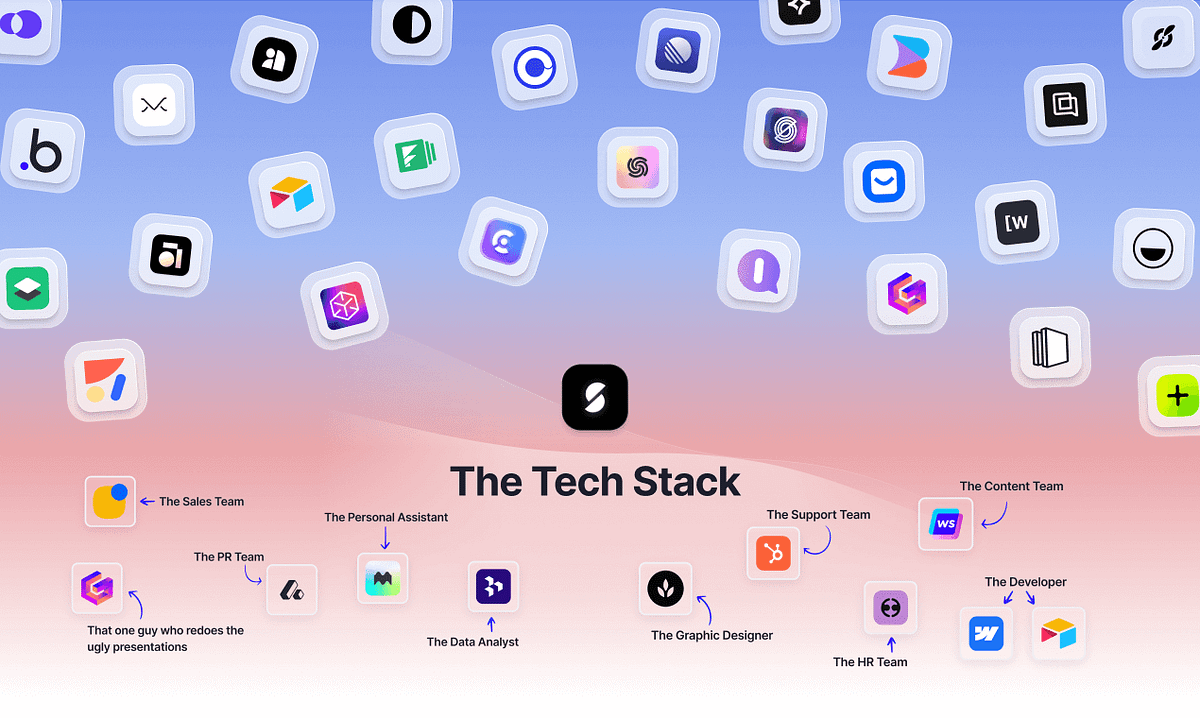

To be able to budget you must first understand where your money is going. Use tools like budgeting apps or spreadsheets to track daily expenses and categorise them into essential and non-essential spending. Apps like Frollo or Up are popular among Australian households for this very reason.

- Plan Your Meals

Food is often one of the largest household expenses so planning your weekly meals in advance helps reduce waste and lowers the temptation of expensive takeout. When shopping, stick to your list and avoid buying items that aren’t necessary. Buying in bulk for staples and cooking at home can save hundreds of dollars over time. Oh, and one more rule which you should absolutely abide by… Never do your food shopping when you’re hungry!

- Prioritise Your Savings

Pay yourself first by transferring a set portion of your income, say 10-20% into a savings account as soon as you’re paid. Automating this process can make it easier to build a savings fund without thinking about it. Aim for an account with high interest rates and low fees to make your money work for you.

- Stop Unnecessary Subscriptions

Streaming services, subscriptions, and memberships can silently drain your finances if left unchecked. Take a moment to review all the direct debits coming out of your account and cancel those you don’t use regularly. Many people, after looking, find out they’re paying for services they haven’t accessed in months.

- Review and Compare Bills

Utilities like gas, electricity, and internet plans often have competitive rates. Regularly compare your current providers with others on the market to ensure you’re getting the best deal. Websites like Compare the Market or Finder can help you compare rates and identify potential savings quickly.

- Use Cashback and Loyalty Programs

Everyday spending can earn rewards if used wisely. You can join loyalty programs at major retailers like Woolworths or Coles to accumulate points that translate into savings. Cashback services like ShopBack or Cashrewards allow you to get a percentage of your spend back on online purchases, adding up to substantial savings over time.

- Budget for Fun

A budget doesn’t mean cutting all enjoyment out of your life, so set aside a portion of your income for entertainment or hobbies. This will help you stick to your budget long-term by preventing the feeling of being deprived. Remember, it’s about balance rather than pure sacrifice, which will lead to overspending.

- Create an Emergency Fund

An emergency fund should be considered as your financial safety net. Unpredictable expenses like car repairs, or sudden job loss can significantly impact your finances. Aim to save at least three to six months’ worth of living expenses. Start small and build your fund over time by contributing consistently.

- Get Professional Advice

Sometimes, managing finances requires expertise that are way beyond your own knowledge. A financial planner can help you assess your current situation and create a tailored budget and savings plan that fits your household’s needs. Professional advice can also help you make educated decisions about investments, retirement, and insurance which are just as important.

By following these simple yet meaningful tips, households across Australia can take control of their finances and work towards a more secure financial future. Even small steps, when repeated consistently, can lead to significant improvements over time.