Have you ever thought about why your small store has trouble with cash flow and unplanned costs? It could be because of problems with checking invoices, which is a very important step that is often missed.

Making sure that bills are checked can have a big impact on how your business runs by giving you a clear picture of your finances and keeping you from making mistakes that cost a lot of money. Read this blog post all the way through to find out how to keep your small retail business’s cash flow smooth and stop scams.

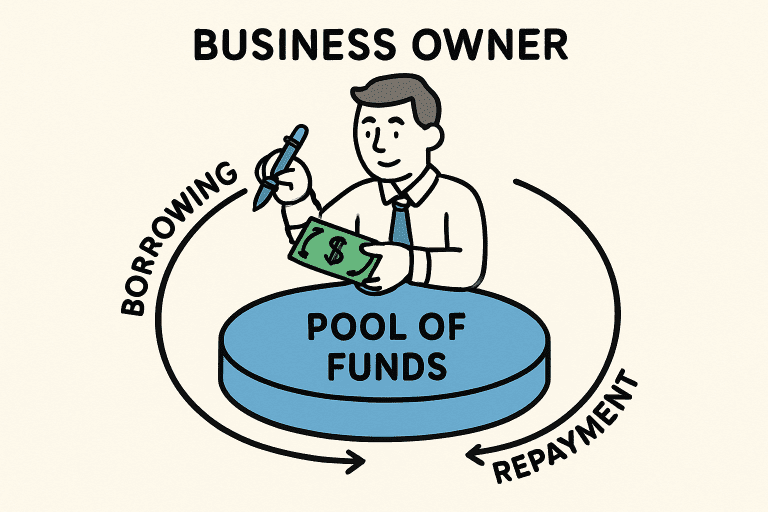

Understanding Invoice Verification

Verifying your invoices is an important part of handling your money. It means making sure that every bill is correct before paying it.

A lot more often than you think, differences show up. Even small mistakes can cost a lot of money. Making sure that every invoice is right is good for business. With the right checks, it’s less possible that payments will be made twice or without permission.

Impact on Cash Flow

Verification of invoices is very important for keeping cash flow healthy. Small stores depend on sellers being paid on time. Any delay can make things less efficient.

Businesses can correctly estimate their costs if they confirm invoices on time. This helps you make a better budget plan. Your business will run smoothly if it has a steady amount of cash.

Fraud Prevention

Fraud is a real danger to small businesses. If there aren’t enough checks, fake or changed bills could get through. This kind of threat can’t get through because invoice verification protects you.

Cross-referencing order information and prices is what it means. Differences are red flags that need to be looked at closely.

Businesses can avoid big losses in money by finding these early. This proactive method makes your business more resistant to fraud.

Strengthening Supplier Relationships

Any small store that sells things needs to have good ties with its suppliers. Payments that are on time and correct build trust.

Payment mistakes, on the other hand, can make these ties less stable. Verification of invoices makes sure that sellers are paid the right amount, which builds trust.

A trustworthy payment method shows that you are an adult. This could help you get better terms and deals with providers.

Ensuring Tax Compliance

When tax time comes around, it’s important to keep your finances in order. Verifying invoices is a key part of making sure taxes are paid correctly. Making tax returns is easier when you keep accurate records.

Making mistakes can lead to fines or reports. Entrepreneurs need to keep good records of their costs.

When you check bills, you keep your financial records clean and reliable. Streamlining this process will save you trouble with taxes in the future.

Benefits of Invoice Processing Outsourcing Services

Small businesses may find invoice management resource-intensive. That’s where invoice processing outsourcing services come in handy.

These services provide expertise and streamline verification. They handle the tedious task of cross-referencing details.

This leaves your team free to focus on other critical tasks. Outsourcing also reduces errors and improves accuracy. Investing in these services is often cost-effective for small businesses.

A Must for Every Small Retail Business

Every small retail business needs to check their invoices. It provides a strong plan for managing cash flow, stopping fraud, and following the rules.

Another benefit is that you can build strong ties with suppliers. These benefits make it clear why taking the time to do this is so important.

How did you find this guide? Good job! Check out our site for more!