Choosing a salary service impacts salary disbursement accessibility in terms of both speed and security. Comparison checks between First Abu Dhabi Bank (FAB) and Al Ansari Exchange help companies and employees determine which platform provides quicker transfers, better rates, and most reliable services for daily financial needs and international money management.

Contents

- 1 Overview of First Abu Dhabi Bank (FAB) Salary Services

- 2 Overview of Al Ansari Exchange Salary Services

- 3 Salary Transfer Speed: Which One is Faster?

- 4 Exchange Rates and Multi-Currency Support Compared

- 5 Fees and Charges: Hidden Costs to Watch Out For

- 6 Additional Benefits: Rewards, Discounts, and Promotions

- 7 International Transfers: Costs and Processing Time

- 8 Security Measures: How Safe Are Your Funds?

- 9 Customer Support: Accessibility and Responsiveness

- 10 Conclusion

Overview of First Abu Dhabi Bank (FAB) Salary Services

FAB offers a full range of salary solutions, including salary accounts, prepaid cards, and WPS-compliant payroll services. It permits the direct deposit of salaries to employees with an option to view the balances instantaneously through ATM/personal/mobile/banking/online portals. Fab Salary Check is easily available through the banking app or ATMs.

Overview of Al Ansari Exchange Salary Services

Al Ansari disburses salary through its PayPlus solution and payroll cards, catered mainly towards those unable to access a traditional bank account. Salaries may be withdrawn swiftly from exchange branches and ATMs, a favorite choice among blue-collar workers. Mobile app options and robust interfaces to international remittances support the services.

Salary Transfer Speed: Which One is Faster?

The transfer is immediate if the employer uses FAB as a Salary Bank, and for other banks, it may take up to one working day. If the salary is WPS-processed on the same day, Al Ansari Exchange provides near-instant access to salary funds through its branches and ATMs.

Exchange Rates and Multi-Currency Support Compared

Al Ansari remains known for exchange rate offerings and multi-currency support, as it is a remittance specialist. It usually offers promotions and competitive rates. FAB also provides currency conversion and foreign exchange services but normally less favorable rates than those of dedicated exchange houses like Al Ansari.

Fees and Charges: Hidden Costs to Watch Out For

FAB may charge account maintenance, low balance, and ATM usage fees outside its network. However, many salary accounts waive fees with a minimum salary deposit. Fees for withdrawals, re-issuance or inactivity may be applicable for Al Ansari salary cards though they mostly avoid the usual bank account fees.

Additional Benefits: Rewards, Discounts, and Promotions

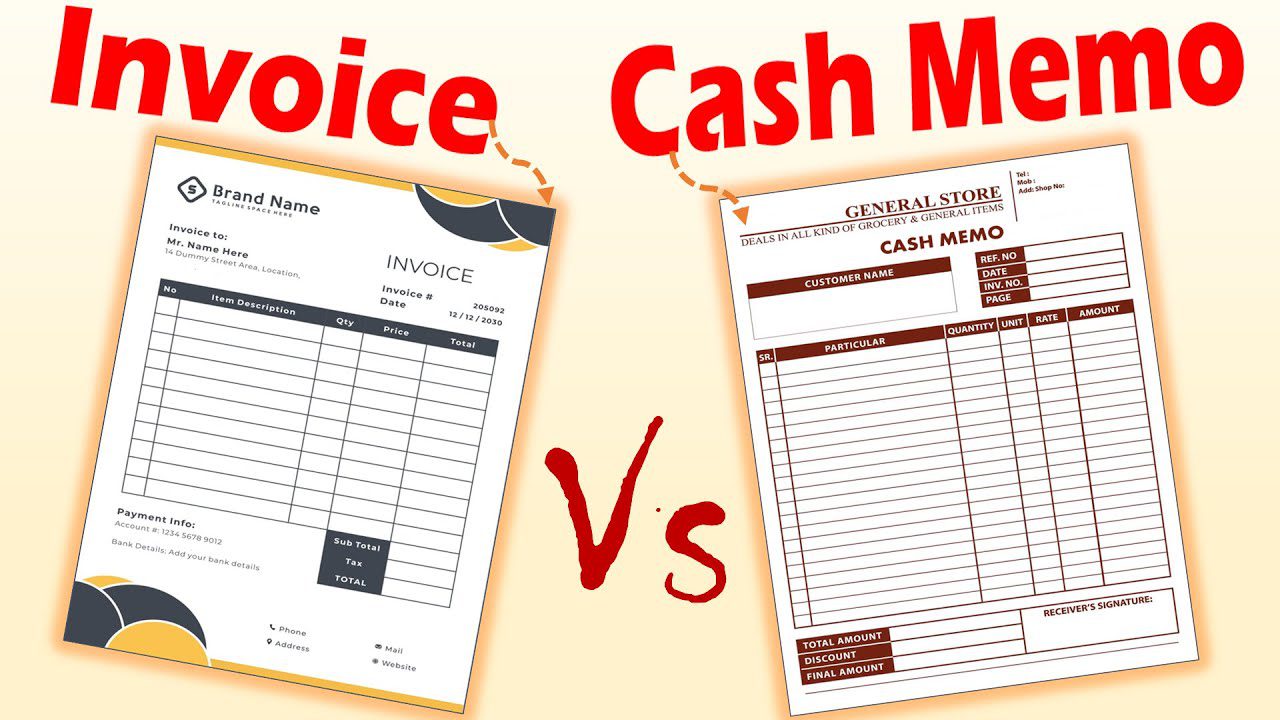

Below is a table showing the difference between FAB and Al Ansari Salary Services in additional services:

- FAB Cashback-based Promotions: FAB issues cashback for specific spending categories. These include groceries, petrol, and online shopping, depending on the salary account holder. These offers make card usage more attractive and are a guaranteed saving on a monthly basis for anyone using the account quite a bit in everyday purchases, bills, etc.

- Easy Borrowing Through Loans and Credit: FAB has provided salary account holders with the facility of pre-approved loans, credit cards, or overdrafts upon salary transfers. Such perks provide a financial cushion so that they can handle an emergency or big purchase with very convenient repayment schedules and favourable interest rates.

- Al Ansari Raffle Draws: Al Ansari sometimes runs promotion campaigns to enter users in raffle draws for cash prizes, gold, and cars upon sending remittances and using the salary card. These incentives are loved by workers and increase customer engagement by providing constant opportunities to win.

- Discounted Charges on Remittances: Al Ansari offers discount remittance charges to salary cardholders, especially for their regular transfers to countries like India, Pakistan, and the Philippines. This makes it cheaper for an expatriate to send money home, thus giving a real value addition in using their salary services.

- Retail and Partner Discounts: FAB account holders enjoy exclusive discounts at partner merchants, including restaurants, hotels, and retail stores. These offers, mostly integrated into FAB’s mobile app, greatly enhance the lifestyle elements of the bank while ensuring the user can patronize such options and save on either leisure or day-to-day expenses.

- Mobile App Promotions: Both FAB and Al Ansari kick in occasional app-based promotions, such as referral bonus points, cashback on bill payments, or points per app use. These promotions add an incentive for the user to do their finances through a mobile platform, adding a benefit for digital banking and ease of access.

International Transfers: Costs and Processing Time

Al Ansari offers the benefits of quicker processing, competitive charges, and affiliations with banks worldwide. FAB also operates in the domain of remittances, mainly for account holders, but with slightly higher charges and longer processing times. However, Al Ansari remains a popular choice for remittance in terms of both speed and cost.

Security Measures: How Safe Are Your Funds?

FAB embraces typical banking regulations, employing encryption, two-factor authentication, and fraud detection. Al Ansari also promises a fully secure transaction, from OTP verification to KYC procedures. While FAB may promise banking-grade security in broader terms, Al Ansari evaluates its compliance from a user perspective and hence protects non-bank users. Al Ansari Salary Check Online and similar services from Fab Bank are available with high levels of security, with no difference between them.

Customer Support: Accessibility and Responsiveness

FAB offers 24/7 support via call center, chat, and physical branches. Al Ansari also provides extensive customer service across its exchange network, including convenient walk-in support. Both services are generally responsive, but Al Ansari’s branch accessibility is usually faster for simple salary card issues.

Conclusion

FAB and Al Ansari serve different segments of the salary market. FAB is ideal for users wanting full banking services, loan access, and digital features. Al Ansari shines in salary disbursement speed, remittances, and accessibility for unbanked workers. The better choice depends on your financial needs, priorities, and lifestyle. You can visit the Emirates Platform to learn more details about the salary card at both leading institutions in this field.