The stranger at the machine.

You’ve seen it.

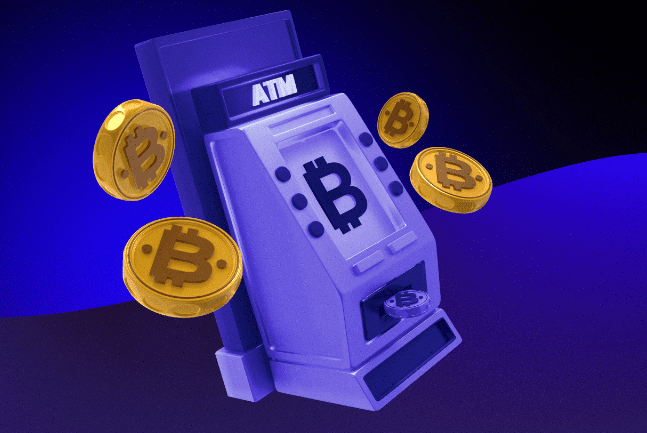

A machine in the corner of a convenience store, glowing blue, with someone feeding it cash like they’re paying tribute to a robot god.

They’re not withdrawing rent money. They’re using a bitcoin ATM—and they might just be showing us where money is headed.

Contents

From “Weird Gadget” to “Oh Yeah, I’ve Used One”

A few years ago, spotting a bitcoin ATM was like finding a rare Pokémon. Now? They’re tucked between lottery machines and energy drink displays in gas stations, airports, even the grocery store where you buy milk.

The reason’s simple: it’s easier than explaining to your bank why you just wired $800 to an online exchange at 2 a.m. You walk up, follow the on-screen prompts, and in minutes—Bitcoin or cash, whichever way you’re going—is yours.

Speed Beats the Bank Queue

Crypto moves fast. Prices swing like a caffeinated day trader. Traditional routes—bank transfers, exchange settlements—move like they’re stuck in molasses.

A bitcoin ATM cuts through that. You can grab cash in minutes. Or buy Bitcoin before the next price jump. No “we’ll notify you in 3–5 business days.”

It’s Not Just Hardcore Traders

Surprise: it’s not only crypto nerds in hoodies using these.

- Travelers grabbing local cash without wrestling with foreign ATMs.

- Remittance senders who move value digitally, letting family pick up bills instantly.

- Small shop owners who take Bitcoin and need a quick way to pay suppliers in cash.

Basically, anyone who hates waiting.

The Access Advantage

In places where banks are scarce or accounts are a luxury, a bitcoin ATM is a financial shortcut. Got cash? You can buy Bitcoin. Got Bitcoin? You can turn it into cash.

No credit score. No “please bring three forms of ID and a utility bill.” Just the basics, depending on your local regulations.

Privacy—Kind Of

Let’s be real. If you’re moving big money, you’ll probably need to verify your identity. But for smaller transactions, some machines ask for little more than a phone number.

It’s not complete anonymity—but it’s enough for people who’d rather not broadcast every crypto-to-cash conversion to their bank.

Yes, There’s a Price for Convenience

Higher fees than online exchanges? Yep. Sometimes 6–12% of your transaction.

Worth it? That depends. If your goal is squeezing every last dollar out of a trade, maybe not. If your goal is having cash in-hand before the dinner bill arrives—absolutely.

Part of Something Bigger

Bitcoin ATMs aren’t just about Bitcoin. They’re about access. About control. About turning what used to be a multi-day, paperwork-heavy ordeal into a five-minute errand you can run on your lunch break.

They’re proof that finance is shifting—from slow, closed systems to something faster, more flexible, and yes… more human.

The Bottom Line

Bitcoin ATMs went from oddity to everyday in record time. They make crypto feel less like an abstract investment and more like money you can actually use.

If the future of finance is about freedom, these machines aren’t a side note—they’re a headline.