Key Takeaways

- Awareness of psychological biases helps avoid irrational investing mistakes.

- Clear investment plans foster discipline and long-term focus.

- Reducing exposure to sensational media minimizes emotional decision-making.

- Diversification and professional input provide peace of mind and balanced performance.

Investing in sluggish markets can be daunting and emotionally taxing, tempting even veteran investors to make irrational decisions. During these periods of uncertainty, maintaining a level-headed approach is essential for protecting and growing assets for the long run. By understanding market psychology and embracing disciplined strategies, investors can make the most of quieter times. If you’re looking to strengthen your resolve during market downturns, it’s worth exploring time-tested bear market investing strategies to navigate these turbulent waters.

Resisting the urge to react emotionally during periods of stagnation is challenging but offers significant advantages for long-term success. Emphasizing process and patience over impulsivity will help you weather downturns and seize opportunities that others might miss. In the following sections, you’ll find actionable steps to reinforce rational thinking, tune out noise, and optimize your investment outcomes no matter how slow the market may seem.

Recognize Psychological Biases

Slow markets can intensify cognitive biases that cloud judgment. One of the most common is loss aversion, the tendency to fear losses more than value gains. This might prompt investors to sell assets prematurely or hesitate to invest, even when fundamentals remain intact. Herd mentality can also wreak havoc, causing individuals to follow the crowd into panic selling or reactive moves.

Recognizing these psychological patterns and accepting that they’re natural is the first step to countering their influence during market lulls. According to CNBC, proactively acknowledging and planning for these biases can help safeguard your investments against emotionally driven errors.

Develop and Stick to a Clear Investment Plan

A solid investment plan is your anchor in uncertain times. Define your asset allocation, risk tolerance, and portfolio rebalancing rules beforehand—then, commit to executing those decisions, regardless of day-to-day market noise. Without a strategic roadmap, it’s easier to be swayed by gloomy headlines or peer pressure, increasing the odds of costly mistakes. A reliable, rules-driven plan keeps your focus on goals instead of distractions.

Revisit your plan regularly to ensure it continues to align with your financial objectives. Adjust only when your long-term circumstances change, not just in response to short-term market movements. This discipline fosters consistency and confidence amid market lethargy.

Focus on Long-Term Goals

With markets moving sideways, it’s easy to become fixated on lackluster performance. However, building wealth through investing is inherently a long-term pursuit. Short-term stalls, corrections, or minor losses should be viewed in the context of your broader financial journey. Consistently remind yourself of major milestones, retirement, paying for education, or creating generational wealth. This perspective empowers you to avoid impulsive actions, like panic selling.

Historical data from Investopedia shows that, despite periodic downturns, markets have overall demonstrated resilience and growth for investors who stay the course.

Limit Exposure to Sensationalist News

Continuous media coverage, especially alarmist in tone, can fan the flames of fear and lead to anxiety-driven choices. While staying informed is prudent, curating your information sources helps you keep calm during periods of low returns. Prioritize updates from trustworthy financial media, and avoid sensational headlines that focus solely on worst-case scenarios. Periodic check-ins, instead of constant news monitoring, can dramatically reduce emotional stress and keep your decisions grounded in data.

Learn from Investing Legends

Emulating experienced investors can offer a blueprint for maintaining rationality when markets slow. Notable figures like Warren Buffett emphasize the power of patience and discipline. Buffett has often said that the stock market is a device for transferring money from the impatient to the patient. Studying the actions and philosophies of these investment greats can reinforce your commitment to disciplined, long-view strategies.

Maintain a Diversified Portfolio

Diversifying your investments across asset classes, regions, and sectors helps protect your overall portfolio from the ups and downs of any single market component. During sluggish periods, this approach cushions returns and provides greater security. Diversification is a cardinal rule among investment professionals, offering resilience and limiting the impact of isolated setbacks on your long-term plans.

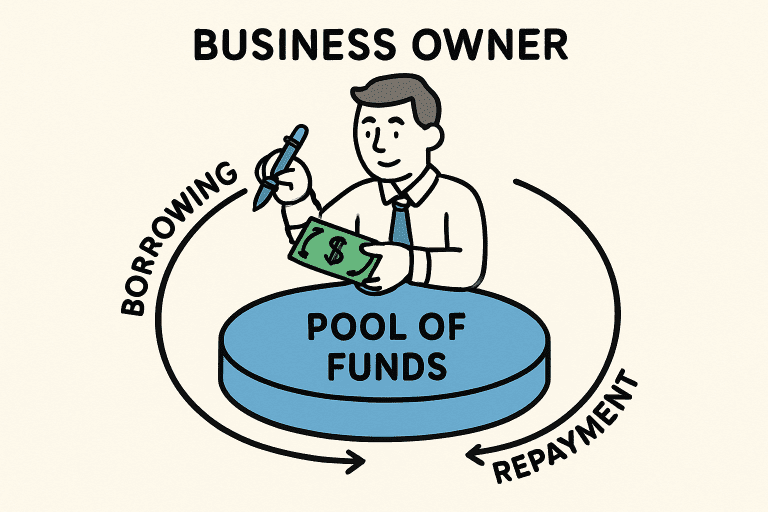

Seek Professional Advice

Professional financial advisors aren’t just for stock picking or tax planning; they’re also behavioral coaches. By providing objective guidance, they help investors avoid knee-jerk reactions and remind them to stick to established frameworks. When doubts and fears surface during slow markets, having an expert in your corner ensures your plans remain rational and grounded in evidence rather than emotion.

Stay the Course

History consistently shows that markets endure recessions, bear phases, and slowdowns, only to bounce back stronger. While past performance doesn’t guarantee future results, trusting in the fundamental resilience of the market can help you overcome short-term anxieties. Remaining steady during lackluster periods, armed with a strong plan and understanding of financial psychology, puts you in the best position to capitalize when conditions inevitably improve.

Implementing these strategies and maintaining patience and perspective can set you apart from those swayed by uncertainty. Careful planning, emotional discipline, and a focus on long-term principles enable you to invest rationally, even in the slowest markets.