Web3 projects rely heavily on influencers to translate complex concepts into relatable stories and rally communities around token launches, protocol roll‑outs, and NFT drops. In the highly competitive Australian market, poor KOL selection can damage brand trust and waste budgets.

This report explains how to evaluate web3 influencers in Australia and structure relationships so that campaigns deliver measurable results and comply with local laws.

It draws on guidance from the Web3 marketing agency, Surgence Labs, the Australian Influencer Marketing Council (AiMCO) Code of Practice, Australian Securities and Investments Commission (ASIC) regulatory guidance, and recent studies on influencer authenticity.

Why care about KOL vetting?

- High trust stakes. Research shows audiences are becoming sceptical of polished marketing and prefer authentic voices. The Meltwater Digital 2025 Australia report found that 75% of Australians worry about distinguishing between real and fake content online, and more than half turn to influencers for product research.

The same study notes that micro‑influencers with values‑aligned communities often generate deeper trust and higher engagement than celebrity endorsements. - Regulatory scrutiny. Token and associated products may be considered financial products under Australian law. ASIC’s Information Sheet 269 warns that finance influencers can breach the Corporations Act 2001 if they (1) provide financial product advice, (2) arrange for people to deal in a financial product, or (3) engage in misleading or deceptive conduct. Sponsored posts that encourage trading or provide affiliate links to exchanges may require an Australian Financial Services Licence (AFSL).

- Influencer marketing codes. The AiMCO Code of Practice outlines vetting, contract, disclosure, and reporting expectations for influencer marketing in Australia. Brands must verify audience demographics, check prior brand relationships, and review recent posts. They should also ensure metrics such as engagement, reach, and conversion are captured so future campaigns can be assessed. Disclosure of any payment, free product, or affiliate relationship is mandatory under the Australian Consumer Law to avoid misleading consumers.

Audience checks – ensuring KOL authenticity

1 Verify follower authenticity

Surgence Labs warns that many Web3 influencers buy fake followers. Brands should look beyond follower counts and check engagement quality. Consistently low engagement rates or a mismatch between likes/comments and follower size may signal bots. Tools such as SocialBlade, Upfluence, and HypeAuditor can detect abnormal growth patterns and fake followers.

Influencer Hero lists practical ways to spot fake audiences, including:

- Check engagement rates. Unusually low or very high like‑to‑follower ratios can indicate purchased engagement.

- Look for irregular growth patterns. Sudden spikes in followers suggest accounts were bought.

- Evaluate audience demographics. Verify that followers are in the right geography and age bracket; AiMCO notes that brands in regulated sectors must ensure the audience is not predominately underage.

- Inspect comments. Bots often leave irrelevant or spammy comments; authentic communities engage in meaningful discussions.

- Use verification tools. According to Surgence Labs, platforms such as HypeAuditor, TweetScout and Upfluence analyze fake followers and engagement quality.

- Leverage micro‑influencers. The Meltwater study highlights that micro‑influencers with aligned values generate higher engagement and trust, making them valuable partners even if they have smaller followings.

2 Analyse reputation and prior behaviour

Working with the wrong influencer can erode brand equity. Brands should avoid profiles involved in failed projects, repeated controversies, or pure “pay‑to‑shill” behaviour. Look for influencers who:

- Post high‑quality content that demonstrates understanding of past campaigns.

- Retain sponsored posts on their timeline for a reasonable time (not just burying them quickly).

- Limit promotions of competing projects to avoid audience fatigue.

- Receive positive community feedback; repeated complaints indicate that trust is being eroded.

3 Ensure value and tone alignment

Crypto KOLs often specialise in niches such as NFTs, gaming, DeFi yields, or Bitcoin. Make sure you align your project with influencers whose tone and community fit your mission. A playful meme account may not suit a serious infrastructure protocol, and vice versa. Micro‑communities within Discord, Telegram, or niche newsletters can be more effective than broad audiences.

4 Avoid legal pitfalls

Under ASIC’s influencer guidance, paid posts that encourage buying or selling crypto tokens could constitute financial advice or dealing if they are intended to influence investment decisions. Brands should ensure influencers:

- Do not provide personal financial advice. Statements like “this token will make you rich” may require a licence and risk regulatory action.

- Do not arrange transactions. Posts that include affiliate links or discount codes to exchanges can be deemed “dealing by arranging.”

- Avoid misleading statements. Claims of guaranteed returns or risk‑free profits may breach the law.

Because crypto assets blur the line between utility tokens and financial products, obtaining legal advice or engaging KOLs who are licensed (AFSL holders) is prudent.

Structuring deals – payment models, contracts, and briefings

1. Choose the right compensation model

Align incentives through clear payment structures:

- Fiat‑based payments. Cash payments create transparent expectations and avoid market sell‑pressure associated with token payments.

- Performance‑based pricing. Compensation tied to metrics like wallet activations, conversions, or community growth ensures accountability.

- Token‑based or hybrid deals. Token compensation can be appealing during bull markets but adds risk and complexity; if used, vesting schedules and liquidation expectations should be clearly communicated.

2. Formalise contracts

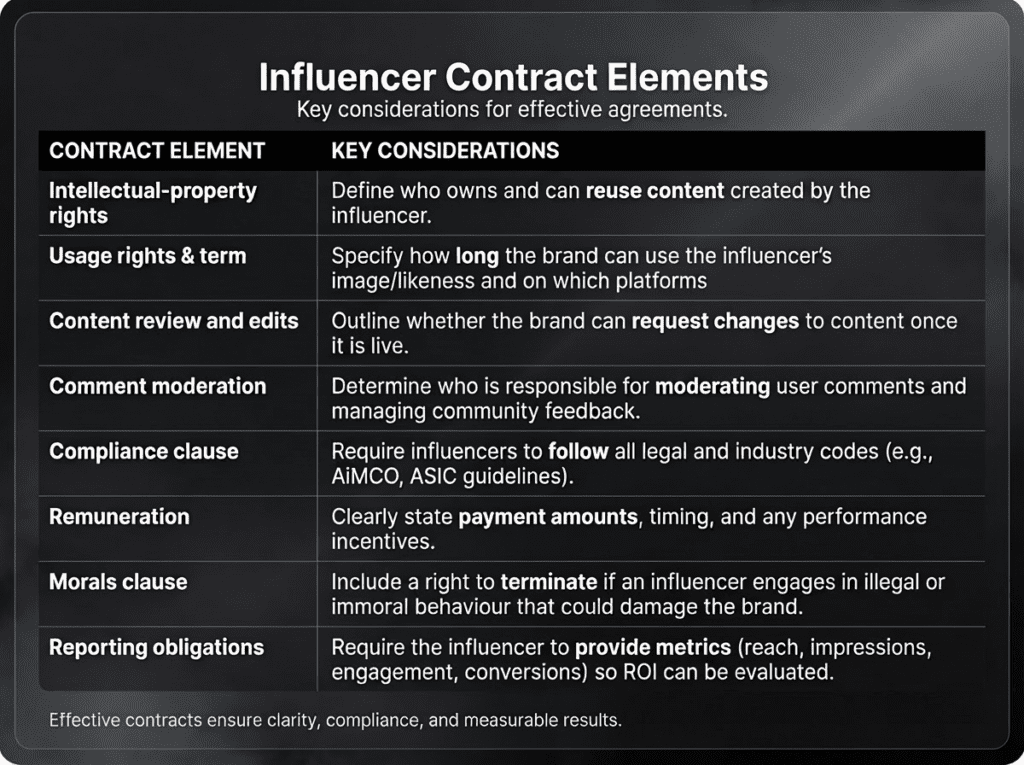

The AiMCO Code provides guidance on essential contract terms. Contracts should cover:

3. Craft a clear brief

Provide influencers with concise guidance on objectives, tone, and call‑to‑action (CTA). Experts at Surgence Labs advice against AI‑generated briefs with no CTA; instead, briefs should state the mission and allow creative freedom. A good brief includes:

- Campaign goals (e.g., sign‑ups, narrative positioning, awareness).

- Key messages and product differentiators.

- Required disclosures (e.g., #ad or platform‑embedded sponsored tags). AiMCO notes that undisclosed paid posts can mislead consumers and breach the Australian Consumer Law.

- Timeframes for content delivery and platform scheduling.

4. Follow disclosure rules

The Australian Consumer Law prohibits conduct that is likely to mislead or deceive. To avoid breaches:

- Disclose any financial payment, value‑in‑kind (free products or gifts) or affiliate arrangement.

- Use clear labels like #ad or #sponsored, preferably at the beginning of captions.

- For video content, display a superimposed “paid partnership” or “sponsored” notice at the start and in the caption.

- Note that gifts are considered payment and usually require disclosure.

5. Beware of financial services licensing

If the influencer’s content could be considered financial product advice or arrangement, ensure they hold an AFSL or avoid giving specific purchase recommendations. AFS licensees using influencers should implement compliance processes and monitor influencer content for unlicensed activity.

Reporting – measuring campaign impact

A robust reporting framework helps determine whether to renew a KOL relationship and ensures compliance:

- Define KPIs and measurement tools. Set metrics such as engagement rate, website visits, wallet activations, sign‑ups, or sentiment analysis. Use UTM parameters, referral codes, and on‑chain analytics to track conversions.

- Capture demographic data. AiMCO advises recording audience demographics alongside metrics. This data ensures that campaigns reach the intended geographic/age segments and helps identify compliance issues (e.g., underage audiences for regulated products).

- Analyse short‑ and long‑term outcomes. Influence may not appear immediately; high‑value creators often generate secondary waves of engagement. Monitor both real‑time engagement and lagging indicators like follower growth and recurring discussions.

- Compare against benchmarks. Crypto campaigns should outperform paid media; average crypto influencer engagement rates are around 5.2 %. Evaluate ROI uplifts (many brands report 4×‑6× returns over paid media) and adjust strategy accordingly.

- Store results for future negotiations. Include reporting requirements in contracts so that both parties agree on data sharing. Transparent reporting fosters trust and informs contract renewals.

Dealing with Australian KOLs – practical tips

- Use formal talent agreements. Many crypto influencers operate informally. Insist on written contracts reflecting the AiMCO and ASIC guidance. For high‑risk financial products, consider working only with influencers who hold an AFSL or partner with a licensed marketing agency.

- Conduct due diligence on past promotions. Review the influencer’s history of crypto endorsements and check whether previous projects delivered on promises. Avoid those linked to rug‑pulls, pump‑and‑dump schemes, or repeated controversies.

- Prioritise community fit over follower numbers. Micro‑influencers and niche educators can produce better engagement and conversion than big names. Leverage local Australian communities on Telegram, Discord, and NFT-specific forums.

- Verify legal compliance. Ensure that marketing copy is factual and doesn’t constitute financial advice. Avoid language that promises returns or encourages speculation.

- Agree on transparent pricing. Clarify whether compensation is in fiat, tokens, or a hybrid model; define performance targets and vesting schedules. Avoid purely token-based payments unless there is a strong rationale.

- Plan for exit. Include a termination clause allowing the brand to withdraw if the influencer engages in conduct that breaches the law or harms the brand’s reputation.

Conclusion

Influencer marketing remains one of the most effective ways for crypto projects to build communities and drive adoption in Australia.

However, the stakes are high: audiences demand authenticity, regulators scrutinise financial promotions, and reputational risks are real.

Robust due diligence (verifying audience authenticity, analysing influencer reputation, aligning values, and understanding legal obligations) protects brands from getting burned. Clear contract terms, transparent disclosure, and comprehensive reporting complete the foundations for a successful crypto KOL campaign.